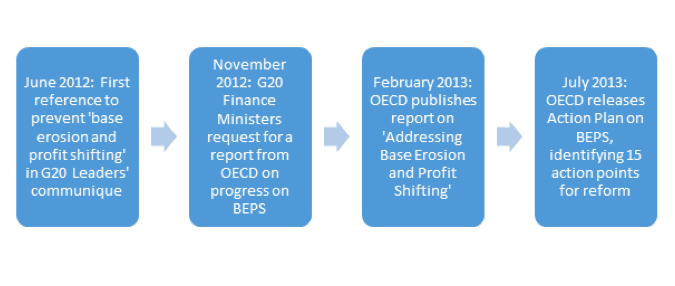

PDF) BASE EROSION AND PROFIT SHIFTING (BEPS) IN LOW-INCOME NATIONS BY THE MULTINATIONALS: A CRITICAL REVIEW OF LITERATURE

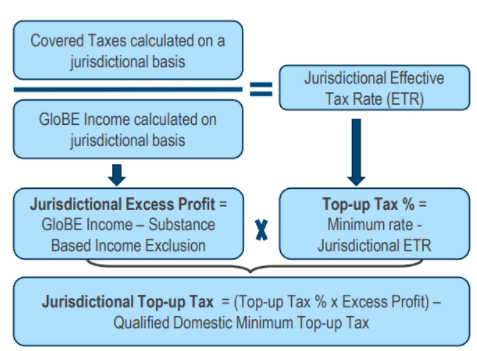

Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting - Wikipedia